- The Independent Authority for Fiscal Responsibility (AIReF) indicates that the debt ratio stood at 2% of GDP in the second quarter of 2023, 0.4 points lower than at the end of 2022

- The recent revision of the GDP by the National Statistics Institute (INE) led to a reduction in the ratio of 1.8 points due to the increase in the denominator

- The figures show the downward path of the debt ratio, which has dropped by 14 points since hitting a ceiling in the first quarter of 2021, although Spain continues to be one of the most indebted countries in the EU

- Following the revision by the INE, AIReF estimates that the ratio will stand at between 108% and 109% at the end of the year, exceeding the latest forecasts by the Government and other international organisations

- Following the sharp rebound in 2022, European sovereign debt yields have remained relatively stable over the course of 2023, although the latest interest rate hike by the ECB has boosted the yields of the main European debt benchmarks to values close to the highs of recent months

- As regards State financing, AIReF indicates that the average cost of new issues has increased from -0.04% at the end of 2021 to 3.33% in August 2023, a value not recorded since 2011

- Indicators like the risk premium and sovereign debt credit insurance indicate that investors do not perceive any deterioration in the financial health of Spanish public debt despite higher yields

- The high yields of short-term Treasury securities have modified the distribution of Treasury bill holdings, with a significant increase in securities in the hands of households and non-financial institutions, rising from a share of 0.1% in July 2022 to 35.2% in July 2023

The Independent Authority for Fiscal Responsibility (AIReF) has published the latest update of its Public Debt Monitor on its website today, which analyses the recent evolution of debt following the latest revision of the National Accounts carried out by the National Statistics Institute (INE) and the evolution of interest rates and debt markets following the latest monetary policy decisions.

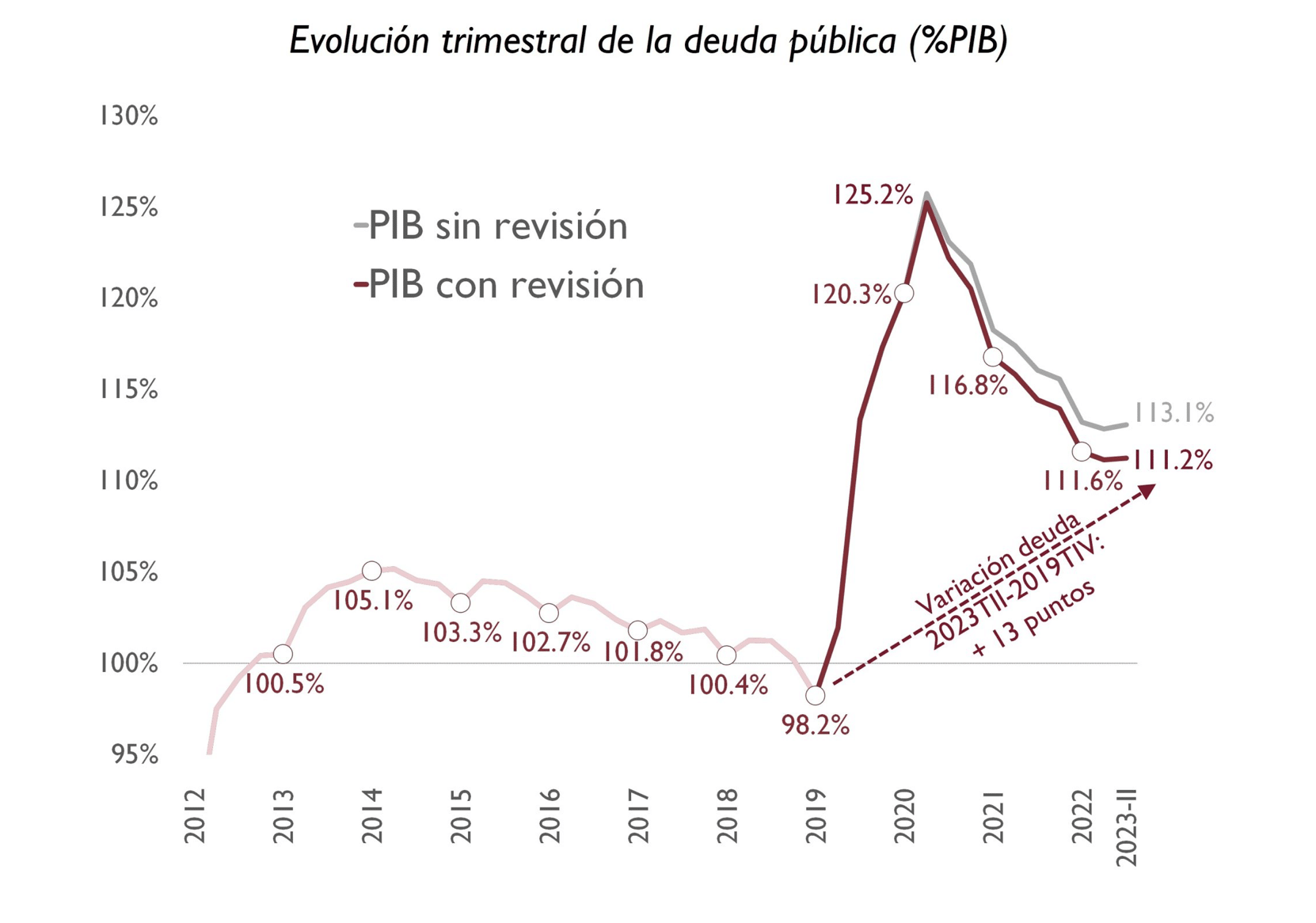

AIReF indicates that the debt ratio stood at 111.2% of GDP in the second quarter of 2023, 0.4 points lower than at the end of 2022, accounting for 3.2 points of GDP in the last year, and 13 points higher than the pre-pandemic level. In monetary terms, in 2023 debt continued to grow at a similar pace to nominal GDP to amount to €1.56bn in July. The recent revision of €23bn of the level of GDP carried out by the INE has meant a 1.84 point reduction in the ratio as a result of a higher denominator. Out of the total, 1.4 points are due to the revision of the GDP from 2021.

The figures show that, following a strong initial increase caused by the pandemic, the debt ratio is now on a downward path. In fact, the quarterly profile maintained a continuous downward path for eight straight quarters, interrupted in the second quarter of 2023 to stabilise at 112.1%. The reduction since hitting a ceiling in the first quarter of 2021 (125.2%) amounts to 14 points. The correction of the public deficit, the rebound of activity and inflation have managed to correct approximately half of the increase caused by the pandemic. However, Spain is currently one of the EU countries with the highest levels of debt, behind only Greece and Italy and with a similar level to Portugal and France. In 2019, Spain was one of the Eurozone countries with the highest debt ratio, a situation since consolidated by the pandemic.

AIReF’s latest projections contained in the ‘Report on Budgetary Execution’ point to a reduction in the debt ratio this year of 3.1 points on the level recorded in 2022 to stand at 110.1% of GDP. However, following the revision by the INE, AIReF estimates that the ratio will very likely stand at between 108% and 109% at the end of the year, exceeding the latest projections by the Government and other international organisations. AIReF estimates that the public deficit will continue contributing to the debt increase in a similar fashion to 2022 and that the reduction in the ratio will mainly be underpinned by nominal GDP growth, where the deflator will play a very significant contribution.

Financing conditions

As regards the financing conditions, the Debt Monitor observes that the evolution of inflation, much higher and more persistent than initially anticipated by the central banks, has forced monetary policy to intensify its restrictive tone in the last year. As indicated by AIReF, there has never before been such a rapid, intense and widespread increase in the interest rates of the different central banks. As a whole, a cumulative rise of between 400 and 500 basis points in global interest rates has been seen over the course of the last year, following a decade of rates close to zero or even negative in some countries. Now that the rates are at clearly restrictive levels and there are sound signs that the transmission of monetary policy is functioning, the monetary authorities have adopted a more cautious approach. Although further hikes cannot be ruled out, the strategy now involves maintaining interest rates with a restrictive tone for a “sufficiently long” period of time, conditioning future decisions on inflation.

Against this backdrop and following a sharp rebound in 2022, European sovereign debt yields have remained relatively stable over the course of 2023, consolidating the levels reached. Furthermore, the markets have started to point to a potential relaxation of financing conditions beyond 2023, which has meant that the long-term debt differential vis-à-vis the short-term differential has narrowed considerably in recent months, marking a minimum at the end of the month of June. The increase in yields as a result of high inflation has been a global phenomenon, which has allowed the Spanish 10-year debt differential to remain stable vis-à-vis its German counterpart. According to AIReF, this fact, together with the maintenance of the contribution from credit default swaps (CDS) at very contained levels is a sign that investors do not perceive any deterioration in the financial health of Spanish public debt despite higher yields.

Cost of financing Spanish debt

As regards State financing, after hitting an all-time low in 2021, the average cost of new Treasury issues has increased from -0.04% to 3.33% in August 2023, a value not recorded since back in 2011. This higher issue cost has also led to a turning point in the average cost of the State’s debt portfolio, which has increased from its all-time low of 1.64% to 2.02%. For its part, the cost of servicing debt of the General Government sector has increased from €5.55bn in 2022 to a total of €31.6bn, accounting for 2.3% of GDP. In 2022, the cost of servicing debt in nominal terms consolidated and accelerated the change of trend that began in 2021 after seven straight years of reductions. If the same implicit rate as 2021 had been maintained in 2022 (1.9% vs. 2.2%), the financial burden would have only increased by €1.57bn, in other words, by €3.97bn less.

As can be observed in the Debt Monitor, most of the increase in the financial burden stems from the increase in the debt portfolio tied to inflation, amounting to more than €8bn. If this increase due to inflation in 2021 and 2022 is excluded, the cost of servicing debt would have continued to drop in 2022, given that bonds issued with relatively high yields continue to be paid out, not far from those recorded over the course of this year. Inflation-linked debt stands at slightly above 5% of the whole portfolio, in line with that of other large European issuers. Beyond the recent economic impact of the high inflation episode on the financial burden, AIReF indicates that maintaining inflation-linked debt is a necessary asset to suitably diversify the Treasury’s investor base to cover high financing needs.

According to AIReF’s forecast, the average issue rate will close 2023 slightly higher than 3%, rising to 3.4% in the coming years. These issue rates will raise the implicit rate to 2.8% and the cost of servicing debt to 2.9% of GDP in 2026.

Changes in the distribution of debt holdings

Lastly, AIReF observes that the high yields of short-term securities have had a noteworthy effect on the distribution of Treasury bill holdings, with a significant increase in securities in the hands of households and non-financial institutions over the last year, rising from a share of 0.1% in July 2022 to 35.2% in July 2023.

Specifically, households have increased their holdings over the last year from €25m in July 2022 to €18.52bn in July 2023, and non-financial institutions from €46m to €6.49bn. Furthermore, the different public asset purchase programmes of the ECB that began in 2015 and were intensified in 2020 and 2021 have turned the Bank of Spain into one of the main holders of long-term Spanish public debt, increasing its share by 23 points of the total debt over the last five years to around 33%.