- The Independent Authority for Fiscal Responsibility (AIReF) issued nine recommendations aimed at strengthening budgetary stability and the expenditure rule

- AIReF’s recommendations are governed by the principle of “comply or explain”, the institution’s main tool to fulfil its mandate

- In general, the Ministry of Finance deviated from following the recommendations, while the Autonomous Regions and Local Governments committed to complying with them

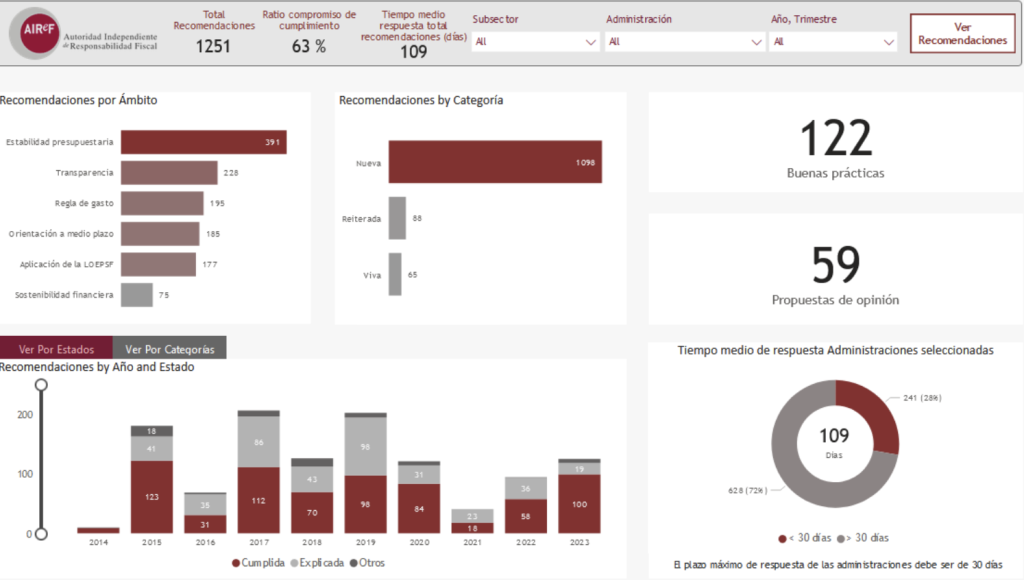

- AIReF creates an interactive tool to facilitate user tracking of the recommendations it issues in its reports, along with the response by the General Government Sector

The Independent Authority for Fiscal Responsibility (AIReF) published on its website today the monitoring of recommendations to the General Government Sector issued by the institution in the third quarter of 2023. In this period, AIReF issued nine recommendations aimed at strengthening budgetary stability and the expenditure rule. AIReF has also made available to users a new interactive tool on its website that allows easy tracking of the recommendations published by the institution in its reports and the response by the General Government Sector.

AIReF issues recommendations in the reports it produces throughout the year. These recommendations are governed by the principle of “comply or explain” – the institution’s main tool to fulfil its mandate. This principle establishes that public authorities are obliged to follow AIReF’s recommendations or explain the reasons for deviating from them. Through the application of this principle, the recommendations made by AIReF lead to constructive and transparent dialogue between the institution and the relevant authorities.

In the third quarter of 2023, AIReF issued the Report on Budget Execution, Public Debt and the Expenditure Rule of the General Government (GG) for 2023, complemented at the territorial level by the issue of individual reports for the Autonomous Regions (ARs) and the complementary report for the Local Governments (LGs) subject to individual evaluation. It also reported on the macroeconomic forecasts for Castile-La Mancha for 2024.

As a result of this evaluation, AIReF issued nine new recommendations that focused on strengthening budgetary stability and the expenditure rule. Bearing in mind that a single recommendation can be directed at more than one public authority, from the perspective of the recipient authority, 90 recommendations were issued: 6 to the Ministry of Finance and Civil Service (MINHAFP), 29 to the ARs, and 55 to the LGs. All the public authorities responded with their intention to comply or explain, except for the Local Governments of Alboraya, Los Palacios y Villafranca, Barbate and Parla. In general, while the MINHAFP deviated from following the recommendations, the ARs and LGs committed to complying with them, which will subsequently be verified by AIReF.

As regards the preparation of the budgets by all public authorities, AIReF recommended MINHAFP to propose reference growth rates for primary spending net of revenue measures for the different public authorities. These rates should consider the temporary or structural nature of revenue and expenditure for each sub-sector in 2024 and be consistent with compliance with the country specific recommendation (CSR) issued by the Council of the European Union. MINHAFP deviated from the recommendation, citing the ongoing discussion and negotiation process of the new European legislative framework. However, AIReF considers it necessary to adopt measures to coordinate fiscal policy and comply with the country specific recommendation for Spain for 2024, where there is no uncertainty as to its formulation.

At the territorial level, AIReF recommended the ARs and LGs under the common regime to avoid spending increases and reductions in revenue of a structural nature financed by the temporary increase in revenue that will take place in 2024. It also advised considering the application of the expenditure rule in 2024, even if this temporarily leads to a situation with a surplus. In a similar vein, but considering the characteristics of the foral regime, AIReF recommended the Basque Country and Navarre, as well as the three foral provinces (Gipuzkoa, Biscay and Araba/Alava) and the City Council of Bilbao to avoid spending increases and reductions in revenue without permanent financing and also consider the application of the expenditure rule in 2024.

In response, the ARs generally committed to complying with the recommendations to varying degrees and subject to various conditions. At any event, AIReF provided a provisional assessment of the risk of non-compliance by ARs in the Report on the Main Lines and Draft Budgets of ARs for 2024. At that time, it identified a potential risk for the ARs of Aragon, Asturias and the Canary Islands due to growth in their expenditure that exceeded AIReF’s forecasts or stemming from the measures notified. There was also a perceived risk in Andalusia, Extremadura, Cantabria, Rioja, Madrid and Valencia due to adopting permanent tax reduction measures, and in the Balearic Islands due to the occurrence of both these circumstances. In addition, in the case of Navarre and the Basque Country, AIReF stated that it was unaware of the content of the measures and policies planned by the region for 2024. At any event, AIReF will finally verify compliance with this commitment made by ARs with the execution of the 2024 budget.

As regards the LGs, all those that responded to the recommendation committed to complying with it: Navalcarnero, San Fernando de Henares, Malaga, Caravaca de la Cruz, Murcia, Totana, Gijon, Vigo, Aranjuez, Sevilla, Gandía, Valencia, Valladolid, Zaragoza, Bilbao, Las Palmas de Gran Canaria, Jerez de la Frontera, Alicante, Palma, Barcelona, Hospitalet de Llobregat, Algeciras, Arcos de la Frontera, Madrid, Los Barrios, Arganda del Rey, La Línea de la Concepción, Puerto Real, Cordoba, Almonte, Ayamonte, Jaen, San Andrés de Rabanedo, Alcorcón; the Island Councils of Majorca and Tenerife; the Provincial Councils of Barcelona, Seville, Valencia and the Foral Councils of Araba/Alava, Gipuzkoa and Biscay. Excluded from this list are the Local Governments of Alboraya, Los Palacios y Villafranca, Barbate and Parla, which did not respond to AIReF’s request regarding their intention to comply or explain.

On another note, AIReF recommended the Local Governments of Algeciras, Arcos de la Frontera and Totana to limit spending increases and reductions in revenue this year that were not consistent with the commitments made to MINHAFP in their adjustment plans and with a notable impact on the growth of eligible expenditure. They were also advised to analyse the structural nature of the increase in spending since 2019 and its compatibility with their revenue policies to align current spending with available revenue. All three Local Governments committed to complying with both recommendations.

Furthermore, AIReF recommended MINHAFP, as the body responsible for approving and monitoring the adjustment plans of the Local Governments of Algeciras, Arcos de la Frontera and Totana, to monitor budget execution in these municipalities. This monitoring should detect spending increases and decreases in revenue that are incompatible with the fiscal consolidation commitments taken on in their adjustment plans and with a notable impact on the growth of eligible expenditure. The same recommendation was directed at their supervisory bodies, but focusing on monitoring budget execution in 2023.

MINHAFP, as the supervisory body of the adjustment plans, indicated that it already conducts periodic monitoring of Local Governments with an adjustment plan in place through the General Secretariat of Regional and Local Financing. For its part, the Autonomous Region of Andalusia, as the supervisory body of the Local Governments of Algeciras and Arcos de la Frontera, and MINHAFP, as the supervisory body for the Local Government of Totana, deviated from the recommendation, considering it exceeded the scope of jurisdiction of financial supervision.

Lastly, AIReF made a recommendation to all LG supervisory bodies to verify the correct application of the criteria of the European System of Accounts (ESA) in the calculation of borrowing/financing needs each year. This particularly pertained to the negative settlement in 2020 of the State Financing System and the application of the neutrality of the RTRP Funds in the settlement made in 2022 and to be made in 2023 and 2024. And, in the event that the ESA criteria were not correctly applied, it warned the LGs affected of the need to rectify these settlements to adapt them to these criteria.

The supervisory bodies (MINHAFP, the ARs with this jurisdiction: Valencia, Andalusia, Navarre, Aragon, Galicia, Catalonia, Castile and Leon and the Canary Islands, Asturias, Rioja, and the Foral Councils of Gipuzkoa, Biscay and Araba/Alava) expressed their commitment to complying with the recommendation regarding their respective LGs. However, some of these bodies (MINHAFP, Galicia, Valencia, Castile and Leon and the Foral Council of Araba/Alava) indicated that its content was not within the jurisdiction of the supervisory bodies.