- The Independent Authority for Fiscal Responsibility notes that debt fell by 5 points of GDP last year and shows a clear path of reduction from the peak of 125.7% reached in the first quarter of 2021.

- In the short term, AIReF projects a further decline in debt in 2023, which would bring the ratio to 110.6% of GDP, basically driven by nominal GDP growth.

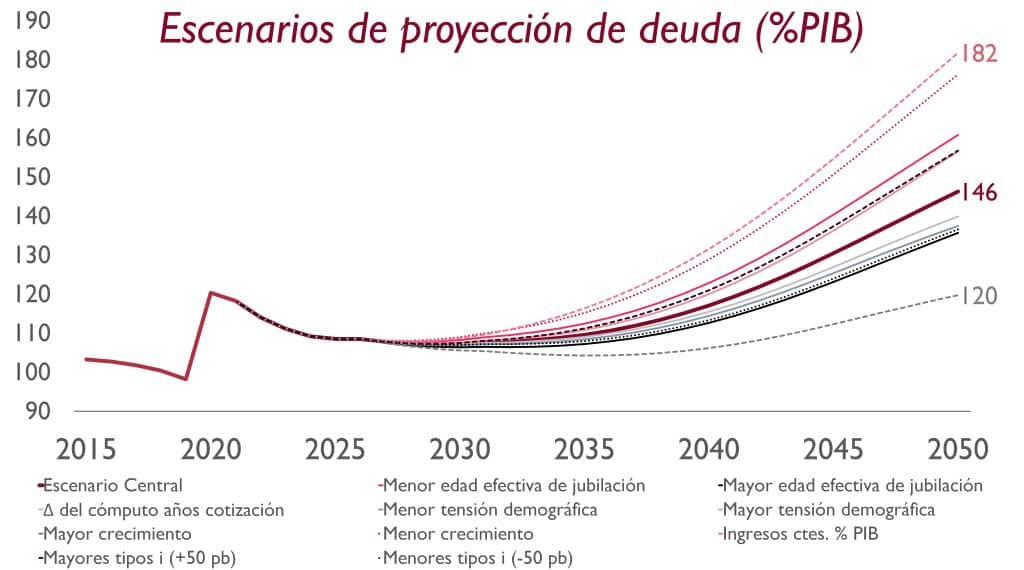

- In the medium and long term, AIReF projects an unfavourable trend in the debt ratio due to the ageing of the population, after an initial period of some stabilisation.

- AIReF notes a turning point in the evolution of financing costs in 2022 and stresses that Spanish debt has maintained the spread with respect to German debt at around 100 basis points.

- Total government interest expenditure has increased by 5,550 million euros in 2022 to 31,595 million euros, which represents 2.4% of GDP.

- The institution highlights the strong increase in the financial burden as a result of the revaluation of the inflation-linked debt portfolio, which has contributed more than 8 billion.

- AIReF notes that the new monetary cycle coupled with the high level of existing debt puts the sustainability of public finances at a highly vulnerable starting point.

The Independent Authority for Fiscal Responsibility (AIReF) today published on its website the Debt Observatory, updated after learning the year-end figure for 2022, in which the Spanish ratio stood at 113.2%, a reduction of 5 points over the year and an increase of 15 points with respect to the level prior to the pandemic. The reduction in the ratio in 2022 has been significant and higher than the forecasts of the various national and international organizations, including AIReF, as a result, among other factors, of a higher contribution from growth.

The contraction of the high government deficit, the rebound in activity and much higher than expected inflation have managed to correct about a third of the increase in debt caused in the first year of the pandemic and put the ratio on a clear downward path. Of the 15-point increase over the last three years, the government deficit has contributed 21.8 points, partially offset by the GDP deflator of 8.6 points, while the contribution of real growth has been virtually zero over the period. Central Government and Social Security Funds have accounted for virtually all of the increase in debt over the last three years, as they have financed most of the expenditure associated with the pandemic.

For 2023, AIReF’s macro-fiscal forecasts project a decrease in the debt-to-GDP ratio of 2.6 points on the level recorded in 2022, which would put the ratio at 110.6% at the end of the year. This forecast improves on the 112.4% presented by the government in the Draft Budget Plan for 2023, which is in line with the latest forecasts of the International Monetary Fund (IMF) and the European Commission. The public deficit will continue to contribute to the increase in debt in a similar way to 2022 and the reduction in the ratio will be supported mainly by nominal GDP growth, where the deflator will make a very notable contribution.

In the Observatory, AIReF notes that the year 2022 has marked a turning point in the evolution of financing costs. The low interest rate environment of recent years has taken a sharp turn in response to the reaction of central banks to curb inflation. The increase in yields has been a global phenomenon, although it is worth noting that Spanish debt has maintained its spread over German debt at around 100 basis points, which in historical terms is relatively low.

The average cost of the State’s debt portfolio has risen from its historical low of 1.64% to 1.73% and General Government interest expenditure has increased by 5,550 million in 2022, to a total of 31,595 million, or 2.4% of GDP. Although the long average maturity of the debt portfolio means that higher issuance rates will be passed on gradually, it should be noted that the sharp increase in the financial burden was the result of the revaluation of the inflation-linked debt portfolio, which amounted to more than 8 billion. On the other hand, the strong growth of the economy has made it possible for the financial burden measured as a percentage of GDP to grow more moderately, registering a turning point after a continuous reduction for eight years.

For 2023, the Treasury proposes a similar financing programme to last year’s, keeping the net issuance target at 70 billion, through the issuance of medium and long-term instruments, with negative net issuance of short-term instruments. Looking ahead, gross borrowing requirements in monetary terms are expected to stabilise and decline in relation to GDP. The decline in net borrowing – linked to a process of deficit reduction – will be partly offset by higher repayments associated with a much higher level of debt.

According to the AIReF Observatory, the State’s debt has a low refinancing risk. The maturity profile of the State’s debt shows that its financing needs are well distributed over the next few years, with moderate maturities in the short term and a granular distribution in the medium and long term, with no concentration of maturities in any one year.

The ECB’s various public asset purchase programmes initiated in 2015 and intensified in 2020 and 2021 have made the Bank of Spain one of the main holders of Spanish public debt, increasing its share of total debt by 25 points in recent years to around 35%. AIReF believes that, in the long term, the reduction of sovereign debt on the ECB’s balance sheet may pose a major challenge that is not without risk, as it will require the return of a large part of the resident investor base that has been displaced over the last few years.

As AIReF states in the Observatory, the new monetary cycle and the high level of debt mean that the sustainability of public finances is at a highly vulnerable starting point. A relatively rapid return is expected over the next few years, from the minimum of 0% recorded in 2021 to average rates for new issues of 3%. These interest rate developments are generating a turning point in the average total cost of debt, which will start an upward path from a low of 1.9% to around 3% in the medium term.

Medium and long-term projections

In the medium and long term AIReF projects an unfavourable trend in the debt-to-GDP ratio. On the basis of the projections published recently in the ‘Opinion on the long-term sustainability of general government’, AIReF projects in its baseline scenario a rising debt ratio after an initial period of some stabilisation. The deterioration in the projected primary balance from 2030 onwards as a result of the ageing of the population will cause debt to resume a rising path that will accelerate to a maximum of 186% of GDP in 2070. In parallel, the debt burden will maintain an unfavourable dynamic even in a scenario of debt cost containment.

Given the uncertainty of the macro-fiscal projections in the medium and long term, AIReF incorporates in the Opinion projections based on alternative scenarios, putting forward different hypotheses on the evolution of the variables related to the institutional elements of the pension system, demographics, the economy, public revenue and interest rates. However, the most favourable scenarios fail to bring the debt ratio below 100% of GDP in the medium term, although they do manage to keep the ratio stabilised over a longer period and project lower debt levels in the future.

In this context, the generation of fiscal space, which is necessary to contain debt developments on the one hand and to deal with shocks such as those that have occurred in recent years on the other hand, requires the design of a medium-term plan to guide public accounts towards a balanced position. The simulations show that the implementation of an early fiscal strategy to contain debt dynamics and the increase in the interest burden will avoid the need for further adjustments in the medium and long run. In fact, the simulations included in the Opinion show that with a fiscal adjustment of between 0.3 and 0.45 p.p. sustained over 10 or 4-7 years respectively, debt in ten years would be at a more moderate level and with a clear downward dynamic.